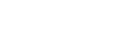

In a Wealth Management Magazine article titled “Senate Democrats Are Coming for Stepped-Up Basis at Death”, that discusses why estate planners have mixed feelings about the proposed Sensible Taxation and Equity Promotion (STEP) Act, Lipson Neilson Shareholder Sandra D. Glazier is quoted in a section called “Comments From the Experts.”

In a Wealth Management Magazine article titled “Senate Democrats Are Coming for Stepped-Up Basis at Death”, that discusses why estate planners have mixed feelings about the proposed Sensible Taxation and Equity Promotion (STEP) Act, Lipson Neilson Shareholder Sandra D. Glazier is quoted in a section called “Comments From the Experts.”

Sandra D. Glazier’s discussion in the article:

The 99.5 Percent Act proposes an increase in the estate tax rates to historically high levels (up to 65%), thereby penalizing those who accumulate wealth. Taxation needs to be fair and shouldn’t penalize any particular class of individuals (wealthy or poor), but seek to reach a balanced approach.

This proposal would require individuals to go back to the days of tracking basis. For those of us who remember 2010, the ability to track basis on assets can often be difficult especially after an individual has died (and for assets accumulated over generations by families, it may be near impossible). This is why paying tax based upon the value of the assets that restarted the basis valuation makes practical sense.

For the vast majority of estates of individuals who died in 2010, trying to evaluate using the then limited adjustment to basis, as opposed to applying the $5 million exemption, was such a nightmare (and for some darn near impossible), all but persons like George Steinbrenner, utilized the exemption/step-up basis regime, as opposed to carryover basis.

It appears that the capital gain tax would be imposed at the time of death, even if assets aren’t liquidated and the gain actually realized. Even with the proposed ability to defer the gain on non-publicly traded assets, this could create a whole other set of problems in terms of the need to liquidate assets in order to come up with the taxes on the capital gain (as well as the estate taxes), as opposed to simply retaining a carry-over basis that would require payment of the tax at the time of liquidation.

It also appears that there would be an imputed transfer every 21 years for assets held in trust under the STEP Act. Many families hold assets in trust for myriad reasons (for example, to protect special needs children, protect the ability of family-run businesses to remain in the family). The 99.5 Percent Act (as I understand it) would in essence impose a 50-year federal rule against perpetuities, which would have the effect of requiring distributions out of trust or an inclusion ratio of 1 at that time, which would appear to make the need for an additional imposition of capital gains taxes every 21 years unnecessary (and could perhaps result in the imposition of multiple tiers of taxation on the same assets).

It seems that these proposals go too far and risk creating a record-keeping (and tax) burden that few will be able to meet.

Sandra D. Glazier, Equity Shareholder in Lipson Neilson PC, in its Bloomfield Hills, Michigan office. The firm has offices in Michigan, Nevada, Arizona, and Colorado, and provides counsel and representation to clients across the country.